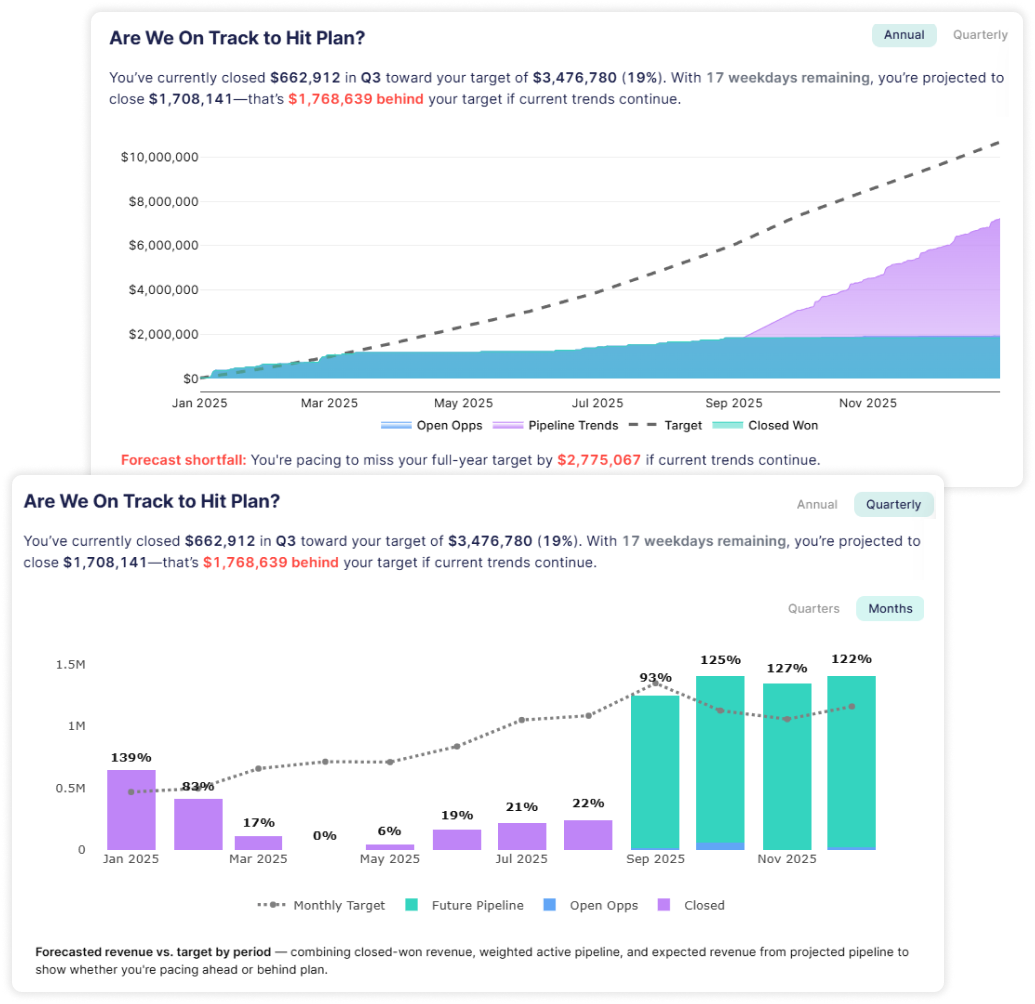

Auto-Weighted Forecasts

No more basic stage-weighted forecasts. We’ve created the algorithms to give you the most accurate and holistic forecasts, so you don’t have to.

RevdUp starts with deal-level probabilities, factoring in stage, risk signals, activity velocity, forecast category, and historical win rates down to the individual, team, or company level, with significance thresholds to ensure relevance. Then, we roll those insights into a multi-lens forecast that includes:

-

Closed-Won Revenue

-

Forecast from Open Opportunities

-

Forecast from Pipeline You Haven’t Created Yet

That last layer, forecasted pipeline, is modeled using current opp creation rates, historical win rates, and average deal cycles, broken down by rep and sub-channel. It gives you a realistic view of where you’re likely to land if trends hold — all built from how your team is actually performing, not how you hope they will.

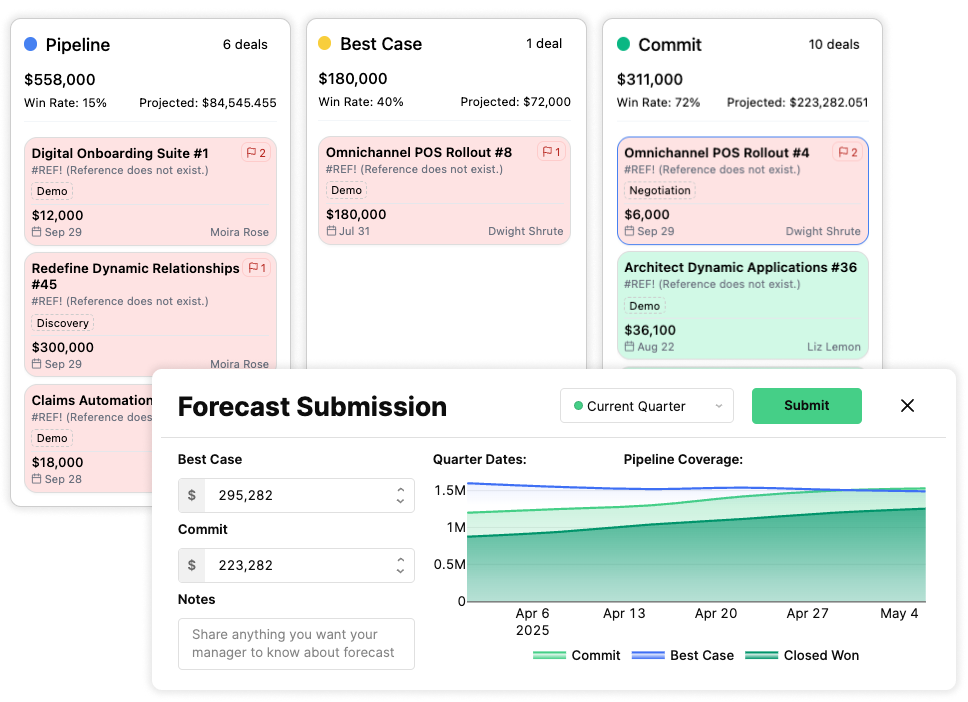

Rep-Submitted Forecasts

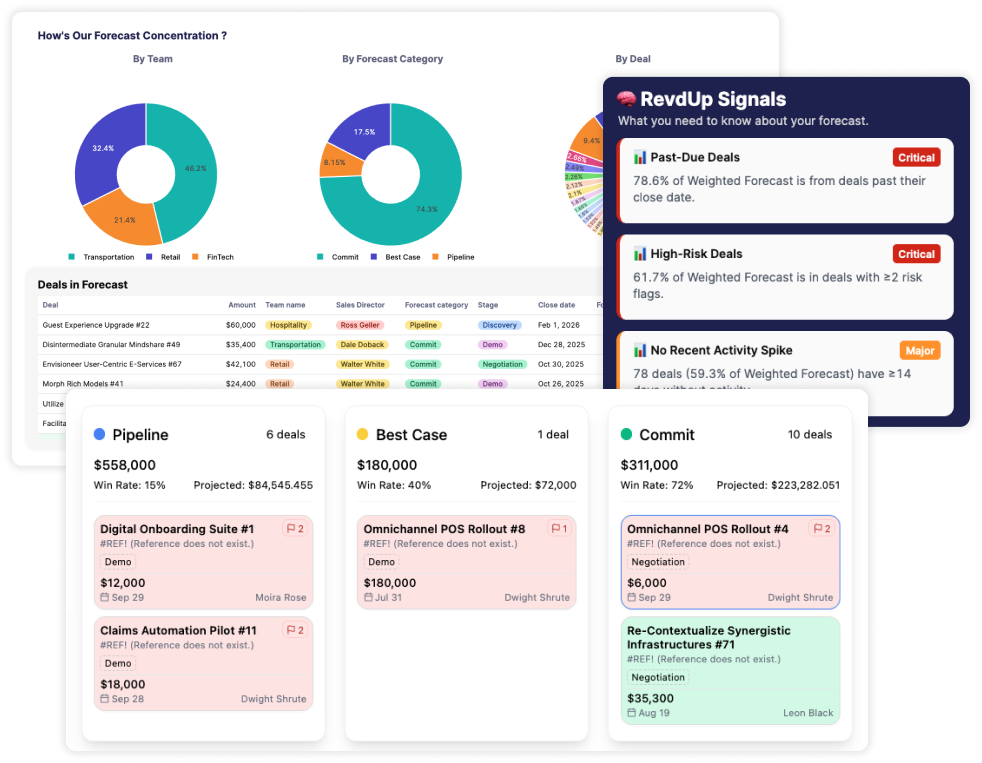

Reps forecast directly inside RevdUp. No spreadsheets. No back-and-forth. They can drag and drop deals between Pipeline, Best Case, and Commit in a Kanban view that surfaces risk indicators for every opportunity.

As they adjust, RevdUp auto-calculates suggested Commit and Best Case values based on historical win rates for that rep, that forecast category, and that point in the quarter. Reps can approve or edit the forecast, while seeing how it’s evolved.

This is accurate forecasting done in minutes.

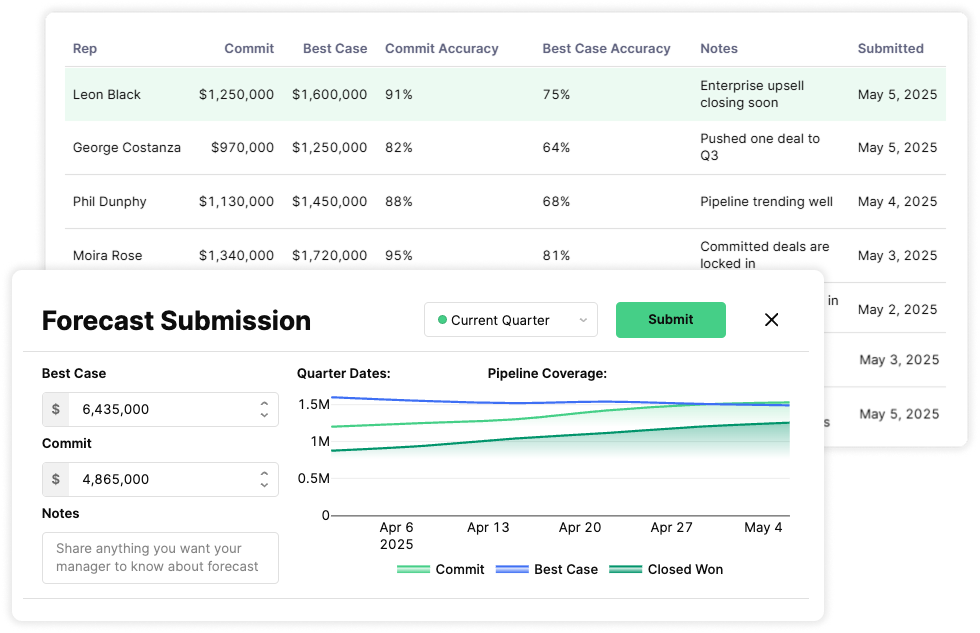

Manager Roll-Ups w/ Rep Forecast Reliability Profiles

Once reps submit their forecasts, RevdUp gives managers a clear, editable roll-up — with each rep’s submitted forecast and historical accuracy in full view. Managers see exactly how much of each rep’s Commit and Best Case typically converts, based on past performance. We call this their Forecast Reliability Profile — a simple, powerful indicator that helps managers adjust forecasts with confidence, while spotting sandbagging or optimism.

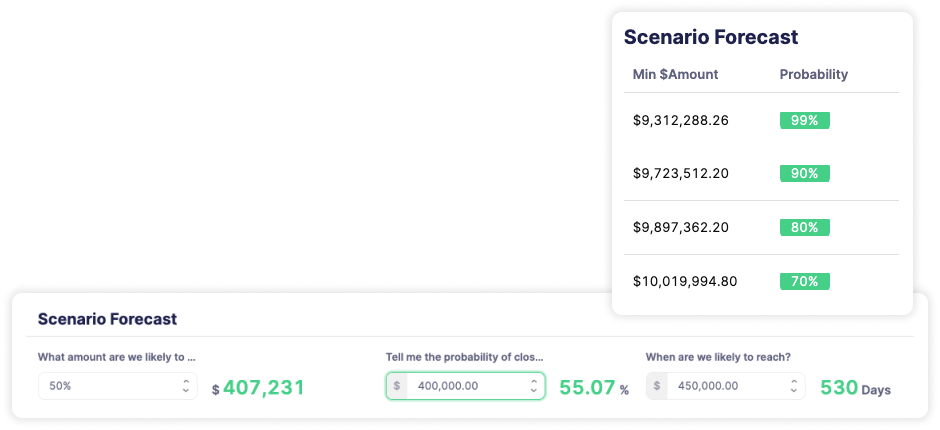

Scenario Forecasting

Sometimes a weighted forecast, even with a full rep roll-up, isn’t enough. Strategic decisions often hinge on one question: How likely are we to hit a specific revenue number? That’s where Scenario Forecasting comes in. RevdUp models the probability of hitting any revenue threshold based on real deal-level data — not just averages. Want to know the likelihood of closing $800K this quarter? We’ll show you the exact odds. No more overcommitting based on one oversized deal. This is forecasting you can plan around.

Tying It All Together

RevdUp pulls every forecasting signal into one consolidated view — so you’re not stitching insights together across tabs and tools. You’ll see:

-

Rep-submitted forecasts, with manager roll-ups and Forecast Reliability Profiles

-

Auto-weighted forecasts, driven by deal-level probabilities

-

Scenario forecasts, showing the likelihood of hitting any revenue target

-

Forecast concentration, so you know if your number is overly reliant on a single deal, rep, or stage

-

And finally, RevdUp Insights tell you in plain English the things you need to be aware of.